Introduction

CFD trading, short for Contract for Difference trading, has gained immense popularity in the financial world due to its potential for substantial profits and the flexibility it offers to traders. In this article, we will explore the world of CFD trading, with a specific focus on the Metatrader 5 platform. Metatrader 5 is a powerful and versatile trading platform that caters to both novice and experienced traders. We will discuss the ins and outs of Cfd Trading Platform, the advantages of using the Metatrader 5 platform, and some essential tips to help you master this exciting form of financial trading.

Understanding CFD Trading

1.1 What Are CFDs?

Before we dive into the world of CFD trading on the Metatrader 5 platform, it’s essential to grasp the fundamentals. CFDs, or Contracts for Difference, are financial derivatives that allow traders to speculate on the price movements of various assets, including stocks, commodities, indices, and more, without owning the underlying assets. Instead of purchasing the assets themselves, CFD traders enter into contracts with their brokers, profiting or incurring losses based on the asset’s price changes.

1.2 Benefits of CFD Trading

CFD trading offers several advantages, making it an attractive choice for many investors:

- Leverage: CFDs enable traders to control larger positions with a relatively small amount of capital, magnifying potential profits (and losses).

- Diverse Market Access: CFDs cover a wide range of assets, allowing traders to diversify their portfolios easily.

- Short and Long Positions: Traders can profit from both rising and falling markets, as they can go long (buy) or short (sell) CFD contracts.

- Hedging: CFDs can be used for hedging existing positions, reducing overall portfolio risk.

- Liquidity: The CFD market is highly liquid, ensuring that traders can enter and exit positions quickly.

1.3 Risks Associated with CFD Trading

While CFD trading offers several benefits, it’s vital to be aware of the associated risks:

- Leverage Risk: Using leverage amplifies potential losses, making risk management crucial.

- Market Volatility: CFDs are sensitive to market fluctuations, which can result in significant gains or losses.

- Overtrading: The ease of entering CFD trades may lead to overtrading, risking substantial losses.

- Broker Risks: Choosing a reputable broker is essential, as it affects the safety of your funds and trade execution.

The Metatrader 5 Platform

2.1 Introducing Metatrader 5

Metatrader 5, often abbreviated as MT5, is a widely acclaimed trading platform developed by MetaQuotes. It’s the successor to the popular Metatrader 4 and is known for its advanced features and functionality. The Metatrader 5 platform is particularly well-suited for CFD trading due to its versatility and comprehensive trading tools.

2.2 Advantages of Using Metatrader 5 for CFD Trading

Let’s take a closer look at why Metatrader 5 is an ideal choice for CFD traders:

- Multiple Asset Classes: Metatrader 5 provides access to various asset classes, including stocks, commodities, forex, and indices, giving traders a broad selection of instruments to trade.

- Technical Analysis Tools: MT5 offers an extensive range of technical analysis tools, including built-in indicators and customizable charts, which are invaluable for making informed trading decisions.

- Algorithmic Trading: For those interested in automated trading, Metatrader 5 supports algorithmic trading through Expert Advisors (EAs) and custom scripts.

- Market Depth: Traders can access the market depth (Level II pricing) to gauge supply and demand, aiding in making well-informed trading choices.

- Risk Management: Metatrader 5 allows you to set stop-loss and take-profit orders to manage your risk effectively.

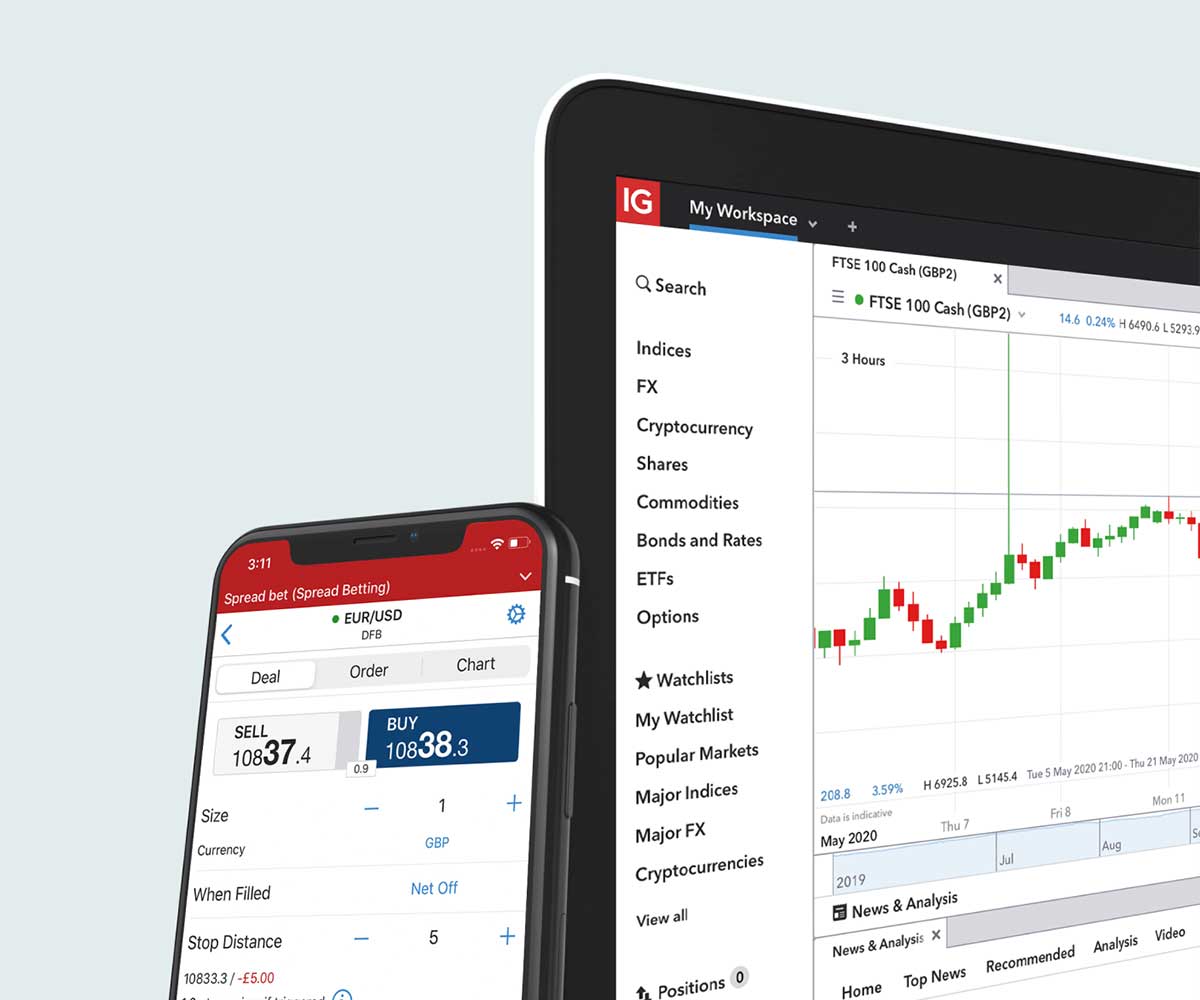

- Mobile Trading: The platform is available as a mobile app, making it convenient for traders to monitor and execute trades on the go.

- Backtesting: You can backtest your trading strategies on historical data to evaluate their performance before using them in live trading.

2.3 Setting Up Metatrader 5 for CFD Trading

Getting started with Metatrader 5 for CFD trading is straightforward:

- Download and install Metatrader 5 from a reputable broker or the MetaQuotes website.

- Open a trading account with a broker that offers CFD trading on Metatrader 5.

- Log in to your trading account within the Metatrader 5 platform.

- Fund your account with the desired capital.

- Start trading by selecting the CFD instruments you wish to trade, conducting technical and fundamental analysis, and executing orders.

Tips for Mastering CFD Trading on Metatrader 5

3.1 Develop a Solid Trading Plan

One of the keys to success in CFD trading is to have a well-defined trading plan. Your plan should outline your trading goals, risk tolerance, and strategies for entry and exit points. Stick to your plan, and avoid impulsive decisions driven by emotions.

3.2 Manage Your Risk

Effective risk management is paramount in CFD trading. Set stop-loss and take-profit levels for each trade to limit potential losses and secure profits. Also, ensure that you don’t over-leverage your positions, as this can lead to significant losses.

3.3 Stay Informed

Stay updated with the latest news and events that can impact the markets. Economic reports, geopolitical developments, and corporate earnings reports can have a significant influence on CFD prices. Utilize the economic calendar available on Metatrader 5 to keep track of upcoming events.

3.4 Use Technical and Fundamental Analysis

Combine both technical and fundamental analysis to make well-informed trading decisions. Metatrader 5 offers a variety of technical analysis tools, while you can use fundamental analysis to understand the broader market context.

3.5 Practice with a Demo Account

Before risking real capital, practice with a demo account on Metatrader 5. This allows you to get comfortable with the platform and refine your trading strategies without any financial risk.

3.6 Continuous Learning

CFD trading is a dynamic field, and it’s crucial to stay updated with the latest trading strategies and market trends. Consider taking courses, reading books, and following financial news to expand your knowledge.

Conclusion

CFD trading on the Metatrader 5 platform provides an exciting opportunity for traders to profit from various financial markets. By understanding the basics of CFD trading, leveraging the advantages of the Metatrader 5 platform, and implementing effective trading strategies, you can master this form of trading and work towards achieving your financial goals. Remember to trade responsibly, manage your risk, and continue learning to stay ahead in the world of CFD trading.